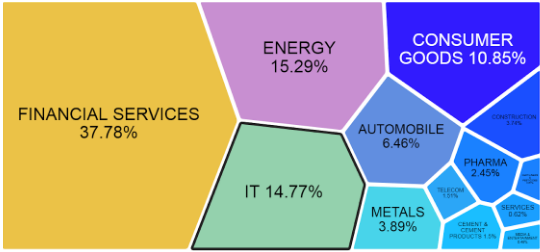

Prior to the year 2000, the companies that dominated the corporate sector were mostly traditional and related to banking, cement, auto, FMCG, metals and some other basic industrials. These companies offered relatively stable jobs, with salary packages tied to inflation and maybe some intermittent bonuses. The topline grew in the range of 10-15% and most of them were profitable. They expanded by reinvesting their profits and seldom due to leverage.

Prior to the year 2000, the companies that dominated the corporate sector were mostly traditional and related to banking, cement, auto, FMCG, metals and some other basic industrials. These companies offered relatively stable jobs, with salary packages tied to inflation and maybe some intermittent bonuses. The topline grew in the range of 10-15% and most of them were profitable. They expanded by reinvesting their profits and seldom due to leverage.

The turn of the millennium witnessed a host of new sectors such as IT, Telecom, Media. This was a game changer and the common man experienced tremendous paradigm shifts in socio economic status. These companies initially grew in the range of 20-30%. They employed the smartest and paid the highest, nowhere comparable to the old generation companies. However they borrowed heavily from banks to cater to their increasing growth requirements. Many of them lost the race half way and shut shop when they couldn’t manage the damages. The employees in these companies were qualified and skilled hence could manage to find other jobs or start their own. In the case of companies who have survived, they currently grow barely at 10% and pay salaries that hardly manage to beat inflation.

Post the global financial crisis the Fed and other global Central bank Governors kept interest rates at near zero levels in order to prop up growth rates and provide impetus to risk takers. Risk taking did happen, in a scale that was never been seen before. Investors borrowed at near zero rates and deployed heavily in ideas that had the remotest chance of success. There was very little to lose. This time companies were also careful not be caught in the debt spiral and hence most funding came via equity. Thus was born a new species of entrepreneurs who came with total disregard to losses and ran companies only with incremental equity infusions. They grew as long as the flow of funds continued and closed down almost immediately when this flow stopped. These companies were to be known as STARTUPS!

A generally agreed definition for a Startup is a company that is newly established, and expects to scale rapidly. The second part of the sentence is what bothers old school people. Scaling up simple ideas rapidly has become the success mantra for these new generation of entrepreneurs. Some have tasted huge success in terms of market share, money and media glory, becoming billionaires in very short time spans. But this is a miniscule minority compared to the number who have failed in the process. The tradeoff here is huge hence the clamor. While several of these companies have managed to identify and resolve our age old problems such as in areas of transport, healthcare, education etc. they have not been able to sort out their own!

The top 20 reasons for startup failure (as compiled by cbinsights) appear very naïve and basic –

1. No market need

2. Ran out of cash

3. Not the right team

4. Get outcompeted

5. Pricing/ Cost issues

6. User unfriendly product

7. Product without a business model

8. Poor marketing

9. Ignore customers

10. Products mistimed

11. Lose focus

12. Disharmony amongst investors

13. Pivot gone bad

14. Lack passion

15. Failed geographic expansion

16. No investor interest to continue

17. Legal challenges

18. Didn’t use network

19. Burnout

20. Failure to pivot

India is currently the 4th largest startup incubator and over $58bn has flowed into nearly 3000 such companies. Much higher than $36bn which entered via FII investments into the country. The top 15 startups have generated a revenue of over $8.5bn in FY19. This comes at a loss of $3.7bn. Losses for the last three years accumulate to over $10bn! These are companies that have been cajoled by the governments and provided several luxuries that are unavailable to stable enterprises for the primary reason that they promise to provide jobs.

But the risk to this is two-fold. Firstly, the risk of sudden layoffs. It is estimated that these top 15 companies directly employ about 1.5lac people and indirectly affect the lives of over 20lakhs (excluding the customers of these companies). With the continuous need for funds to run the show, there is always the risk of closing down lingering…a dagger hangs by the thread for most of these employees. These startup entrepreneurs are well educated, street smart, highly networked and quite capable. Hence shutting shop and starting afresh would seldom be a problem for them. But certainly that’s not the case for their staff. Compare this to the top 15 old generation companies that have grown slowly but steadily.

While they have faced cyclical downturns, there has seldom been a case of major lay-offs atleast in the scale witnessed in these aggressive growth oriented companies.

Secondly, majority of the startups are technology driven and based on a complicated algorithm. This requires very few people at the managerial level, easily scalable and asset light business model. The biggest expense is for salaries (mid/lower level support staff) and discounts. The majority are employed in low value addition jobs such as driving, delivery boys, call centers etc. There is no skill that is generated in these employees who are in the age group of 18-30yrs. Rather a large amount of skill is wasted over a period as these semi-skilled and semi-educated people could otherwise be encouraged to practice a vocation that will improve their abilities.

The startup industry is a time bomb waiting to explode. The loss numbers globally and locally are mind boggling. The money flow into startups is startling despite the failure rates. The hype and aura surrounding it should subside and capital should be put to use in more tangible real assets that offer meaningful sustainable returns. Taking eyes of the profit number and focusing only on revenue is certainly not something to be taught in schools. The most important of all, declining standards of employability will become dismal in the years to come as the youth increasingly focus on making the quick buck by doing jobs much below their potential.