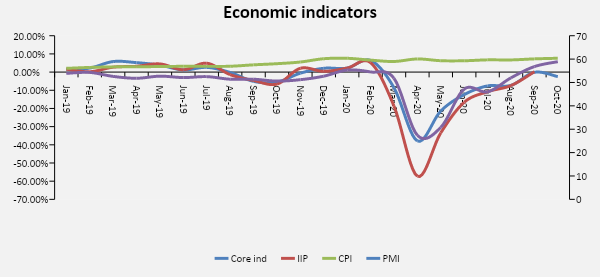

Post the recent GDP announcement there has been a continuous debate regarding the recovery of the Indian economy. While nobody doubts a recovery, the debate is primarily on the shape and period – U, V, W are some of the proposed types and 2-5years is the general drift on time period. The graph below evidences several macro indicators rebounding from the lows of the first quarter. Certainly, looks like V for now, is this be sustainable, what are the pain points ahead…

Core industries, IIP and PMI are production metrics which had been low all through 2019, worsened further this year. GDP declined 24% in the first quarter and 7.5% in the second. RBI estimates the next 2 quarters to be marginally positive and we would end this year with an average decline of 7.8%. The metrics would certainly look better next year due to the base effect. However, to ascertain the sustainability of the production levels will depend on the demand scenario. Most of the demand that arouse in the second quarter is attributed to the production catching up with lag due to lock downs, building up from a low inventory position to prepare for festival sales. We need to observe if this tapers off and companies start scaling back production resulting in pulling the shape of the graph southwards again (i.e V becomes W).

One simple measure of demand is inflation, which has held through mid-single digits all through this pandemic. RBI targets inflation by end of the year to be around 6.5% and is accommodating by a repo rate much lower. Not clear now if inflation holding up due to data collection not fully recovering and supply side constraints, rather than actual demand growth. Despite a low interest rate and surplus liquidity regime, the real estate, consumer durables, travel, entertainment have been under severe stress due to the lack of demand under gradual opening. Some estimate of loss of GDP potential are at 20%. There will be a loss of output to the tune of $350-400 bn which may take a while to return. The biggest casualty of this would-be job losses for the common man, re-skilling to- new sectors, which keep consumer spending & confidence under pressure. Hence demand for some sectors coming back to pre-covid levels does not mean the economy will be the same again next year (i.e V becomes U).

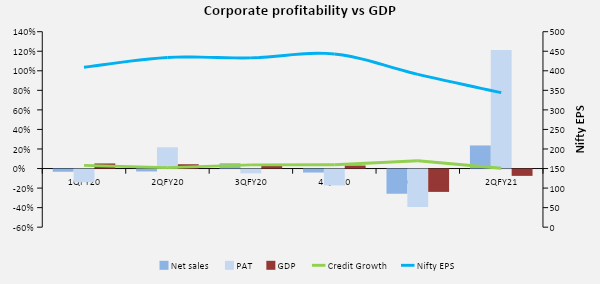

Corporate numbers also indicate a similar trend. Topline in the second quarter improved by 23.6% on a Q-o-Q basis while bottom line jumped 121% from the lows of the previous quarter. Clearing of inventory, lower purchases, reduced employee cost and high pent-up demand has translated into this stupendous improvement in profits. Zooming out on the Nifty 50 earnings, we observe it was at Rs.450 in the beginning of 2020 and currently it languishes 20pc lower around 360, long way to go.

Another interesting data came from, the K.V. Kamath committee, which was created to provide targeted sector-wise relief to the borrowers. The committee came out with an interesting finding, 29.4% of the total banking debt was impacted by the pandemic alone while another 42.1% was already facing stress before the outbreak. Which basically means, about 72% debt of the banking sector is under severe stress. The committee also recognized that the best of the companies has been affected, businesses that would have otherwise been viable have gone bad and the impact is sector agnostic. Proposals from the committee included, moratorium, restructuring, waiver, and other such concessions. Adding to this problem are populist below par, non-collateral loans such as MUDRA etc. provided to MSMEs; significant portion of which have gone bad and look irrecoverable. Banking sector faces a triple whammy- subdued credit off take, low interest income and rising NPAs. This is a real and present danger the system faces. Short term balance sheet dressing may last only for a few quarters.

Governments have generally followed Keynesian principles during a crisis. They prop up spending, create confidence and gradually private investments follow. However so far this year, the country has not witnessed capital investments either from government, private or foreign players. Allocating funds towards pandemic emergency and other social revenue measures have put pressure on Government infrastructure spending. The delay in new project pipelines impact confidence levels for private players. Ability to focus and execute on the disinvestment target of Rs.2.1 tn for FY21, looks impacted too. Government may find it hard to manage fiscal prudence with lower tax revenues. It is estimated that fiscal deficit will rise to high single digits or more by next year. Rating downgrades come into play in case of that scenario.

All these pain points when viewed in the context of the stock markets surging, makes us grab popcorn to watch. There has been a flood of liquidity from foreigners in the last couple of months, averaging Rs. 30 bln+ per day of late. Fear of missing out has taken the street by storm and retail investors have shrugged off everything negative. Bears have been trampled beyond recognition and valuations have skyrocketed (Nifty is currently trading at 36x PE, which is about 63% higher than the 10-year mean!). All this is attributed to the success of the vaccine, by many, which might bring back normality to the system probably in 6-12 months down the road. We need to observe cash-flow at that point to understand the new normal that emerges. Business models would have changed, humans would have evolved by then and the entire ecosystem might look different going forward. Visualizing the outcome of this complex unfolding system is a tad difficult at the current juncture. Good to stick with poker-face, cut the euphoria surrounding the shape and observe the unfolding economic growth, while conserving cash at such times to invest more prudently later.