“The definition of insanity is doing the same thing over and over again, but expecting different results.”

Policy makers all around the globe have stuck to classical theories which have suggested creating a benign environment when things go bad. They believed people would do better if interest cost and tax rates are reduced. Demand would prop up and the ripple effect will eventually get the economy going. In order to provide an accommodative stance, Fed got the rates to zero post the Y2K crisis, other central bankers followed. What ultimately took place was an artificial housing boom which went crazy and created another mayhem bigger than the previous. Billions of dollars were lost in the process, but we excused the policy makers as we thought they had learnt their lesson and this would not repeat.

Post the Global financial crisis, again interest rates were reduced to near zero both in US/Europe, and additionally the flood gates of liquidity were opened. After more than a decade, benchmark rates have continued to remain at the same levels but GDP growth has not improved. Instead we have a scenario wherein 20% of the global bond markets trade at negative yields and nearly 60% trade at less than 2%. Most of the liquidity has moved into risky asset classes such as venture capital/startups/hedge funds which have taken the stock markets beyond even the speculators imagination. Very little has trickled into real infrastructure and industry. How much more benign should the government get in order to propel growth, or is there something wrong in the way the crisis is managed. Are we repeating the same mistakes over and over again?

Clearly the relationship between interest rates and growth has decoupled and we are yet to learn from the past. Even radical steps of moving into negative interest rate territory has not worked. Interest rates as a primary tool of monetary policy, to stimulate investment, employment, and inflation is gradually failing. The situation in Japan is a perfect case study of zero growth under zero interest rates. 90% of the new money created by the Bank of Japan since 2013 has ended up back as deposit in the central bank. In the Euro zone, low interest rates have created a frightening vortex of declining margins in banks, high operating costs and no takers for loans. Reports suggest that ECB receives over €20 billion as fees from banks for parking funds at negative interest rates!

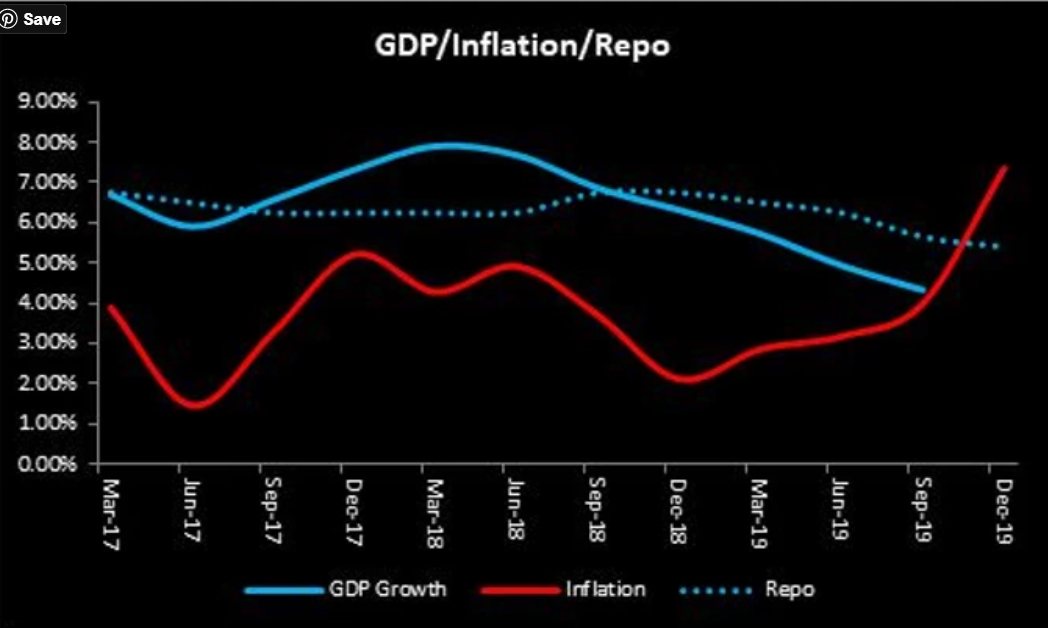

The chart below summarizes the following about the Indian scenario- Firstly, inflation has moved beyond the repo rate indicating a negative real interest rate scenario. Secondly, the rate of inflation is higher than the rate of GDP growth aka stagflation. Thirdly, the accommodative stance by RBI does not seem to drive demand as witnessed in the GDP slump despite a low interest rate regime.

Economic theories are supposed to evolve with time like any other subject. However we go by textbooks written at least half a century ago when the situation was nowhere near to what it is today. Globalisation and technology have changed the way countries operate and business models work. Old theories need an overhaul and the reforms have to be radical not superficial. Reforms that will increase demand, jobs and help execution of infrastructure.

India by following the failed routes of the west is succumbing to the same spiral. One such recent big bang reform was the corporate tax cut announced about six months ago. The cut will shave off over $20bn from the coffers. But we are yet to see any pick up in interest either from foreign or local entrepreneurs which will compensate for the lost revenue. On the flip side, RBIs recent LTRO was a timely reform and will prove effective in atleast transmitting lower rates into the system, if not deployment. It is such out of the box measures that will prove successful in the long run.

Low interest rate regimes cannot be a new normal. It will force savers to take undue risks such as allocating more into the stock markets even at record highs. Fixed income products will also fall out of favor especially with the Pension class. The dopamine effect will eventually have to subside at some point and then will occur the whiplash. The impact caused by the artificially induced low interest rates and inert policy actions will remain for generations to come. The time to make the reforms is now, even at the cost of losing elections. Precedence in policy making has to change. Kicking the can down the road will not work any further as we are soon approaching a dangerous curve ahead.