In the bygone era, the Fund manager used to rely heavily on information asymmetry in order to select stocks for their portfolio. Funds were managed based on the information that was privy to a close set of people. This was the time of no internet, few telephone connections and almost non-existent regulations. Envisaging long term growth in companies based on research was more of a myth because there was hardly any public data available for such activity.

We have come a long way from that age. Several important changes that have taken place in the last two decades and have caused a paradigm shift in the fund management industry.

Regular information flow from companies have become mandatory and exemplifies good corporate governance which in turn is an important aspect of stock selection. Majority of the companies have set up separate investor relations department which cater to this need. Quality and timing of information from companies is very important to provide comfort to foreign as well as local institutional investors who rely extensively on research and data. Development of the internet has made this information gathering easy and hence vanquishing the problem of material asymmetry.

Likelihood of insider trading, circular trading or benami accounts have declined significantly over the past with the advent of dematerialization of shares and surveillance being done electronically. Tracking and tracing of illegal accounts have become relatively easy. While rigging of share price continues, it certainly is not rampant as it used to be.

Market participants have increased manifold and no longer a ghetto of specialists that control the trend. More importantly, the level of cognizance regarding companies and market trends by the millennial investors has improved due to the availability of data, increase in education levels and deep media coverage. Various discussion forums serve as a platforms to dissipate information and knowledge freely.

This increased efficiency in the information flow has had a un-expected fallout- The Active Fund Manager.

The performance of active vs. passive investors is narrowing down greatly. The cost involved, fees to be paid and inconsistency of returns have made the active fund managers an over-rated lot. Past performance is almost never an indicator of the future.

Selecting a stock after several years of research and continuous follow up involves significant amount of time, effort and money. Since all the research done is based on past data, an extrapolation into the future involves significant amount of ambiguity and mostly left to chance. Risk of research failure is mostly unacknowledged and left unpunished as there is always a “Disclaimer”.

Rising influence of algo trading and robo advisory has also been an important reason for the advent of passive investing. Robo advisors are creating passive investors by disciplining them through technologies that embody canonical models of financial economics. Robo advisors and their algorithms influence their users and objectify them by automating their investment decisions.

Did you know one of the largest Asset Management Company in India has also been the biggest underperformer in many categories that it operates. Nevertheless they continue to have a huge following, loyal base of clients and their AUM grows primarily due to a brand image that they have created over the past and an overall positive opinion in the media regarding their fund managers. It is also because of their already well-established access to the huge retail and corporate network. Investors flock in more due to the efforts of the distribution and marketing network as a “push product” and less due to the risk adjusted performance.

Did you also know the largest fund house in the world manages only ETFs and other such index following schemes. These passive funds now form the majority of Assets under Management across the world. The Big Three index fund managers (BlackRock, Vanguard, and State Street) alone cast around 25% of votes in S&P 500 firms. The tectonic shift of money into ETFs and other such passive funds evidences the incapability of the active fund manager to beat the benchmark consistently. The new generation players in India such as the Bansal backed Navi and Kamath promoted Zerodha are coming up with ultra-cheap passive schemes to garner majority share. This is convenient to operate for the Asset Management Company using technology and less manpower, moreover it is also easier to convince the investor because there is no question of outperformance or underperformance.

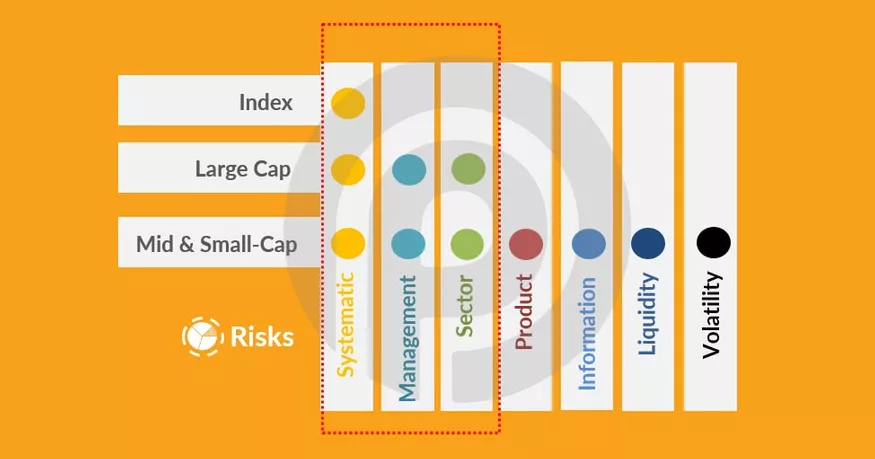

We at Pelican believe in a hybrid model of combining the active and passive way of managing funds. Staying active should not mean churning the portfolio regularly, rather actively tracking the trend in fundamentals, the macro parameters of the stocks selected, and the risk appetite levels of the overall market. We select a basket of 8 solid companies clearly defined by certain criteria, which have seldom required change. In the case of pure play ETFs the portfolio gets widely distributed, hence there is little scope for alpha generation. However marginal exposure to ETFs provide the adequate broad market participation. The concentrated portfolio offers the outperformance, while the ETFs and Large caps reduces the risk. Hence the combination of both ETFs and stocks in our portfolio provide the maximum risk adjusted returns.

Efficiency of the market will increase as we move ahead and information will be available to everyone at pretty much the same time, thanks to technological advancements. The high amounts of capital and time spent on having an informational/analytical edge will dissipate fairly quickly and eventually not be worth at all. Our edge at Pelican is neither informational or analytical as we believe both are increasingly becoming redundant. We focus our strength on institutionalizing our temperament and providing an objective process to buy and sell over a long time horizon. Impatience and desire to avoid volatility on the part of others will present the opportunity.