“Learn from the mistakes of others. You can’t live long enough to make them all yourself” …

Stock market is a great place to study about winners and losers. Since there is money involved it makes the story even more interesting. Each story provides several insights into the do’s and don’ts of investing and all we must do is to imbibe the knowledge left over by the people before us.

By any measure of scale, Warren Buffet towers in the list of great investors. While every fund manager swears by the Guru, seldom do they follow him in any way. We, diligent followers of Lord Buffet, have managed to implement some of his important tenants for the well-being of our investors. We believe his words of wisdom are applicable under every condition.

1. Frequently, the best decision is to do nothing

The basic premise is that over a long term the stock markets reflect the economic status of the country. During that long term, mispricing’s may occur, and they create opportunities to invest. These do not occur every day though. Investors need to allocate funds and be prepared to invest at the appropriate time whenever it occurs. In the meanwhile, it is best to do NOTHING.

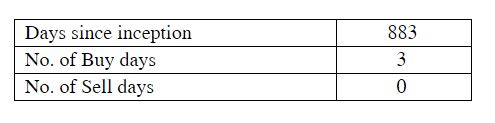

The decision to act or not to act is based on the robustness of the investment plan and meticulous following of a process. To avoid ambiguity in stock selection and being swayed by exuberance or panic of the market, we at Pelican PMS have selected a set of stocks that would be purchased at predefined levels. We change a stock only if there is significant long-term change in the fundamentals of the stock selected and sell when predefined levels in the overall market is reached. Otherwise, we stay still and give time for the underlying cashflow to grow. This avoids unnecessary churning of portfolio, subjectivity and reduces costs. The table below indicates the typical number of days Pelican PMS has been active for a client-

2. In the short-term the market is a voting machine; in the long-run it acts as a weighing machine.” Occasionally, the voting decisions of investors –amateurs and professionals alike – border on lunacy.

Assets are investment vehicles which have undefined time periods to earn undefined returns. Mature assets at steady state have cash flows that can be reasonably discounted to current date. Any useful asset will grow like a tree over a period and produce fruits only when they mature. It is best to give only a cursory glance to results in the short term and ignore the daily chorus of dramatic, ominous, or euphoric views.

At Pelican PMS we focus on market cycles. Historically every cycle has taken about 5-7years from trough to crest. Growth is a function of how these cycles manifest and are managed by various companies. These cannot be gauged in the short term and it is futile to attempt to do so. Hence, we work only with weighing machines.

3. Financial staying power requires a company to maintain three strengths under all circumstances: (1) a large and reliable stream of earnings; (2) massive liquid assets and (3) no significant near-term cash requirements.

Portfolios should be constructed with stocks that can wither any storm. Basic filters such as reliable stream of earnings and robust balance sheet (high cash and low debt) serves the purpose. Corporate governance and solid track record will auger well to reduce significant risks. Investing money with such companies put the odds in the investor’s favor.

Stock selection criteria at Pelican PMS follow similar filters. Companies that have adhered to the above criteria, vindicated track record of corporate governance and top position for several years form the basic construct of our portfolio. By investing in large cap companies and market leaders we manage to avoid several unknowns, have better data for analysis and institutional buying support.

4.The ability to fight off the ABCs of business decay, which are arrogance, bureaucracy, and complacency.

The classic error of successful investing is the change in attitude once successful. Achieving success is only one part of the story, staying there makes all the difference. Delusions on personal intelligence and capability to foresee the future, are usual suspects that have caused trouble.

Pelican PMS has structured its strategy to be process driven rather than based on the whims and fancies of the fund manager. Our model is more quantitative than qualitative, leaving little room for personal attributes to creep in.

5. If our noneconomic values were to be lost, much of Berkshire’s economic value would collapse as well

Inherent attitude towards life is non-monetary, but they form the backbone for all the actions taken. The core of Pelican PMS is client’s interest first. Our qualitative aspects include transparent reporting of performance and expenses, low churn rate, no entry or exit charges, maintaining adequate margin of safety and offering a good night sleep.

Success of the biggest investment company Berkshire Hathway has been the consistency in the way it operates. They simply avoided most of the common mistakes and moved away from the conventional methods. We at Pelican PMS also intend to do the same, thanks to the wise men we live and learn from!