There has been a triumph of euphoria in the last five years which has led to the benchmark indices doubling. However the underlying earnings has remained flat with an absolute growth of a meager 4% during the period. This has led to PE expansion a.k.a Bubble like scenario. The Nifty 50 trades at a trailing PE of 29X which is the highest ever it has reached, thanks to the heightened optimism and the unprecedented fund flow (both locally and from foreigners). In order to revert to its long term mean the Index PE will have to decline by atleast 27%. This can happen in three ways, either there should be a significant earnings upgrade or the price decline or a combination of both.

There has been a triumph of euphoria in the last five years which has led to the benchmark indices doubling. However the underlying earnings has remained flat with an absolute growth of a meager 4% during the period. This has led to PE expansion a.k.a Bubble like scenario. The Nifty 50 trades at a trailing PE of 29X which is the highest ever it has reached, thanks to the heightened optimism and the unprecedented fund flow (both locally and from foreigners). In order to revert to its long term mean the Index PE will have to decline by atleast 27%. This can happen in three ways, either there should be a significant earnings upgrade or the price decline or a combination of both.

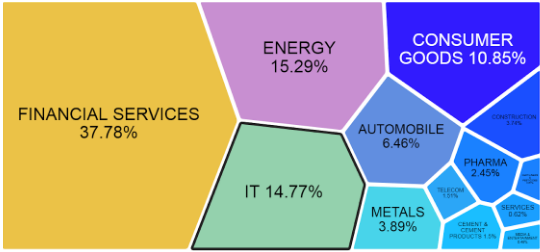

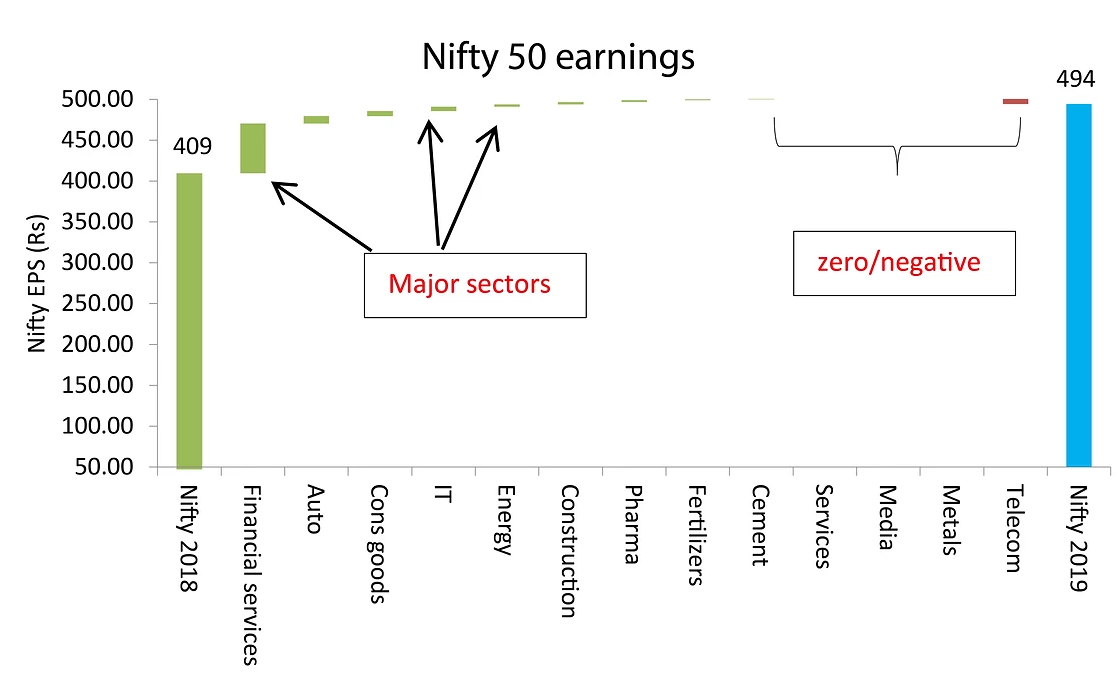

Let’s dissect the earnings first. Nifty 50 consist of three major sectors that contribute to nearly 70% of the entire weightage of the index: Financial services, IT and Energy. Hence it is clear that if the benchmark has to witness any growth in earnings it has to come from these three sectors. The remaining are certainly not heavy enough to move the earnings needle.

In the case of financial services, except for provision write backs by some banks which may result in a significant rise from a low base, there is unlikely to be any core income growth. The sector is further burdened by liquidity and solvency crisis which is not fully reflected in the economy yet. Similarly the IT sector is facing headwinds and even with a benign dollar the best expectation is only a single digit growth. The case with energy related companies is also no different. Consumer goods, Automobile and Metals are all facing low demand. The below chart indicates the expected contribution to the Nifty earnings from each sector (collated from prominent sell side analysts).

With regards to the price, a decline may happen due to many factors ranging from strictures by the government, reduction in fund flows, scams, change in sentiments or just a loss of appetite for equities. While none of this is can be gauged effectively there are technical indications of bulls wearing out. With no scope for an earnings upgrade, the only way the Nifty PE levels could revert to the mean is via a price decline (bad luck!)

Hapless politicians appear to have run out of fiscal measures and are blaming Central Bankers for the current economic decline. But Central Bankers can do only what they can do best, manage monetary policy, reduce interest rates (which they have done already) or resign! German, French 10yr bonds are subzero, Italy is at all-time lows, US treasury 10yr is soon breaking the 2% support levels. India on its part is also nearing an all-time low level. Negative yielding bonds have risen to $13.4 tn in value which includes $608bn in corporate bonds globally. This further accentuates the case for a bear market.

Cul-de-sac is often not an exact synonym for dead end and refers to dead ends with a circular end, allowing for easy turning at the end of the road (..wiki). Which means, there are times when you need to invest and there are times when you have to turn around and save your money, so that you can invest later. Superior investment returns are possible only if both of these are maneuvered well. Low corporate growth, declining GDP levels and high valuations make it a clear case to reduce exposure to risky asset classes making it the perfect time to save aggressively. Great opportunities are usually missed only because of the lack of ear marking of funds at such junctures. Once the funds are allocated for investing for a later period, there will be little panic, fear or doubt which eventually is the cause for poor decision making.