The advice from parents is derived from their own success or failures. But considering the drastic changes that have taken place in the last couple of decades, it is almost impossible that their experiences match that of the current generation. Millennials would receive three conventional wealth creation master ideas…which will neither meet their aspiration or investment goal. Conversely, it may be the reason for the financial struggle’s that they may face in the long run.

Advice No1: My Dear…insurance is very important in life (rather…in death)

A generation ago, most households had a single bread winner in the family. It was very important to see a smooth transition in case of an untoward incident. Insurance played a very important role then. Initially it was just plain vanilla term insurance (which was more than adequate), but financial innovation and pressure from the sales guys led to a variety of products. We now have over 25 Life insurance companies offering hundreds of schemes, most of which are seldom understood by the seller or the buyer. Insurance is also commonly (mis)sold as an investment product, showcasing the dual advantage of growth in value as well as promising an insurance coverage. However, there are caveats…

As the economy grew and education levels improved, most households now have more than a single bread winner and multiple sources of income. The reliance on insurance has gradually declined in such cases. While its importance cannot be understated, it should only form a small part of your capital allocation rather than become the focus. A simple term insurance is the cost-effective way to cover your debts and leave enough for your loved ones (if you have any!).

Please note insurance is not a wealth creator (at least for the person paying the premium).

Advice No2: Buy a house and settle down in life (…welcome to the world of EMIs)

Owning a home has for long been considered a necessity and primary requirement to prove a person’s financial security in the society. But today’s lifestyle changes and reality of the workplace implies that the first location they work at is almost never where they will remain forever. Demographic structures around the world are becoming dynamic, families are becoming increasingly nuclear as a result of the opportunities that accompany rapid globalization. Older generations bemoan spending income on rent as a bad idea, implying it can be used to repay EMIs for home loans and create an asset in the process. Why is this conventional idea flawed…?

Firstly, increasing supply of urban housing has decreased rent on homes to roughly one third of the monthly mortgage repayments (EMIs) driving the average age of buying a house upwards.

Secondly, rental yields net of maintenance costs are less than 2% and is expected to remain that way in the foreseeable future, making it one of the lowest yielding investment option. Thirdly, real estate is a sticky asset class and to find a suitable buyer or seller at an appropriate price and time is a difficult process. Finally, for people on the move, renting is the best option as they are provided with a plug and play model which can reduce the extant of liabilities while relocating.

So, look at buying a house close to retirement, by which time your other investments would have grown significantly and your needs would have reduced to the minimum (at least you wouldn’t have to be near a school or office or in fact anywhere within the city by then).

Advice No 3: Let’s talk to our Banker for investment advice (the last person you should reach out to)

There was a time when the neighborhood bank manager was the unofficial CFP (certified financial planner) of the family. Any investment advice would start and end with a Fixed deposit (FD) or a Recurring deposit (RD), the tenure of which will also be his discretion. RMs are paid by the bank and based on the number of investment products sold. They are forced to push new schemes, closed-ended schemes, ULIP products etc. which earn higher commissions; instead of working in the best interest of the customer. Also, improvements in technology imply that individuals will rarely head to their branch or meet their RM. Most RMs are generally under qualified to advice on investments and at best work as liaison agents. Hence, they should be the last person you should reach out to for any investment advice.

Modern investors have access to a wide range of information and services that can help them develop the required understanding on the investments, so pause to critically evaluate and take prudent decisions. Most importantly check the source of your advisor’s income.

Typical monthly asset allocation

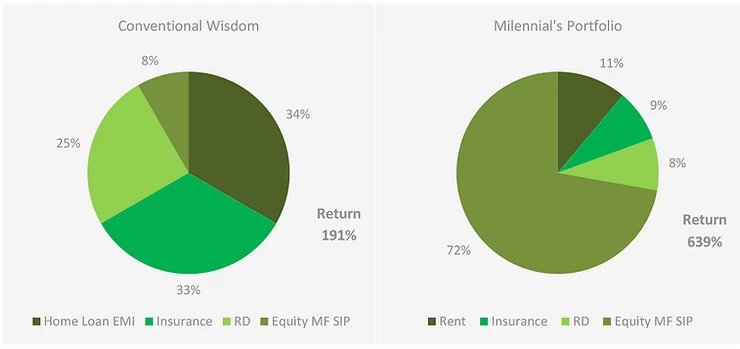

A typical asset allocation using conventional advice would divide your portfolio into 3-4 parts; each of which would be illiquid, low yielding and unable to even beat inflation. Millennials would require a more dynamic, flexible and liquid asset allocation strategy which can cater to their lifestyle as well as preserve enough for the future. When we run a typical portfolio based on the conventional idea vs. the millennial approach, it is easily observed that the returns are significantly higher (over a 20-year period).

Prudent investment would start with shedding the old habits and ideas of the earlier generations and creating new strategies to suit the current scenario.

So, beware of advice from Uncles, Aunties, Dads and Moms…don’t concede to emotional blackmails.