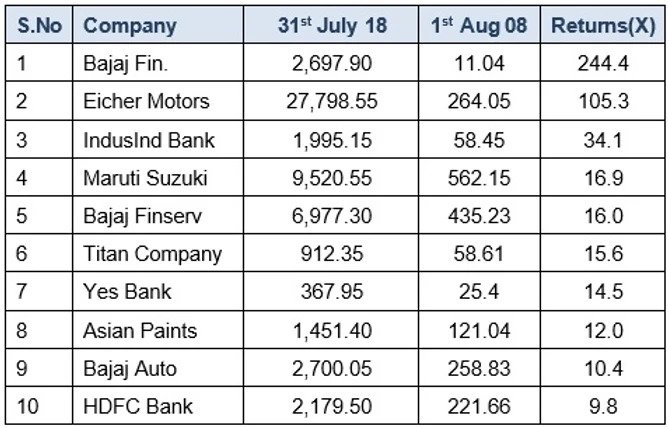

Now that we are at crossroads (or though it seems like), it is an appropriate time to look back and introspect. This has by far been the longest rally for the Nifty and has lasted for over 7 years (and not finished yet!). The previous cycle ended with the crash of 2008, and the markets bottomed out in 2009. Ever since, Nifty has appreciated by over 4.3X. We take note of the top 10 performers who surpassed expectations and returned over 10x during the last 10 years. What made them outperformers and is there a common thread connecting these companies? Can the learning’s from the past hold answers to the future…

One of the key reasons for the success of any company is the continuity in strategy. This is possible only if the leadership is stable. All of these top performers have had no change in their top management for several years. Sanjiv/Rajiv Bajaj of Bajaj Finance/Bajaj Auto and Siddartha Lal of Eicher Motors have been instrumental in turning around their respective family businesses into modern institutions. Today these institutions are amongst the best in their own segments. When Romesh Sobti and his team moved into Indusind in 2007 little did anyone expect such a drastic change within this ailing Bank. Today it boasts of being amongst the top banks in the country; and the dream run continues with the same team. Rana Kapoor of Yes Bank and Aditya Puri of HDFC Bank have been at the helm since the inception of their respective banks. They have managed to maintain a boringly steady rate of growth without compromising on asset quality. RC Bhargava (Chairman, Maruti), KBS Anand (MD/CEO, Asian Paints) and Bhaskar Bhat (MD, Titan) have all been associated with their respective companies for their entire careers. They are industry veterans and have taken their companies to leadership positions.

Many companies in the past have taken unnecessary bets and aggressively acquired overseas in an attempt to showcase themselves as a Multinational Company. However most of them have only failed and the assets have given more pain than gain. None of the companies in the top 10 list have attempted any such acquisition nor have they proceeded outside the domestic market, catering only to local/intrinsic demand. This has helped them focus their resources in areas where they can do best. Offering products and services that cater to the larger audience, scalable operations and use of technology have been the main reasons for the success of these companies. Bajaj Finance, Maruti, Asian Paints are excellent examples of entities that have made good use of the market they exist in. Bajaj Finance has introduced an array of financial products targeted at the large middle class population. Easing the lending process with products such as pre-approved EMI cards have been a great hit amongst the consumers. In the case of Maruti, they have continuously launched passenger vehicles that have delighted the common man. Despite significant competition, Asian Paints has maintained over 50% market share and has been the biggest beneficiary of the boom in domestic construction industry.

Maruti despite its growing production line has remained a zero debt company, so is the case with Asian paints, Bajaj Auto and Eicher motors. Even in the case of the Banks and NBFCs, the leverage ratio has been much below industry standards. With no interest outflow, the cash from business has been ploughed back; resulting in a compounded growth over the years. The focus has always been on making cash profits and this has worked well with all of them.

I guess the writing on the wall is clear!